How to choose a health insurance plan

I recently had to buy independent health insurance, and I was immediately overwhelmed with my options. From just one provider I was given quotes for 24 different plans. I needed something to help me make some sense of them all.

There are a few key features of all health insurance plans:

1. The monthly premium you pay, for the privilege of doing business with an insurance company.

2. The deductible, or the amount you will have to pay for expenses before the insurance company begins to pay for anything.

3. The coinsurance percentage, or the proportion of costs after the deductible you will have to pay.

4. The coinsurance maximum, or the total amount you could possibly have to pay after you’ve met your deductible.

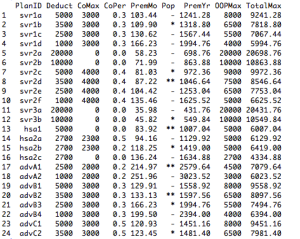

I made a table of all 24 plans and these four features, using the premiums I was quoted online. I calculated some other features, such as the Out-Of-Pocket maximum (deductible + coinsurance max), the annual premium, and the TotalMax cost to me (OOPMax + annual premium). Having the data in this format will help us to visualize the plans better.

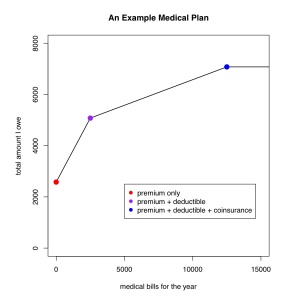

Consider a plan with $2500 in annual premiums, a $2500 deductible and 20% coinsurance up to a maximum of $2000. I’ve plotted your total health care costs (y axis) as a function of your total medical bills for the year (x axis). Even if you have no medical bills, you still pay $2500 in premiums (red dot). You then pay for all medical bills until you reach your deductible (purple dot). Having met your deductible, you now pay only 20% of further expenses (shallow line) until you have paid an additional $2000 (blue dot). At this point you have incurred $12,500 in medical bills for the year, and have paid $7000. The line is flat after this, because you have reached your coinsurance limit, and the insurance company will pay the rest in full.

The lower the line is, the less you will pay.

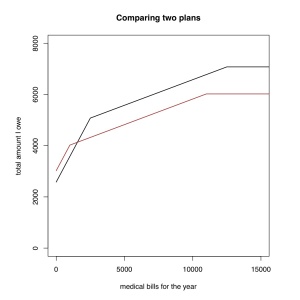

Let’s compare this plan to a second plan, shown in brown. This second plan has a lower deductible ($1000) but a higher annual premium (~$500). You can see that if you have very few medical expenses the first plan (in black) is better because the second one has a higher premium. But if you have more than about $1500 in bills you would pay less with the second (brown) plan because of the lower deductible. For most people the plan in brown is probably a better choice.

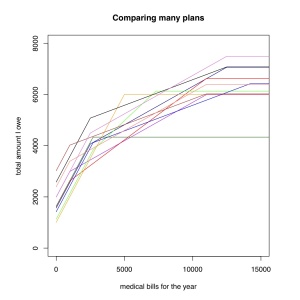

Now comparing all 24 plans this way would be pretty messy. So I decided that under no circumstances could I pay more than $7500 in total for the year (premium + deductible + coinsurance). That way, even if something catastrophic happened, I’d still only pay $7500. This eliminated plans with really high deductibles (as high as $20,000!) and coinsurance, leaving only 11 plans.

See how our first plan (in black) compares to all these other plans? It is one of the most expensive plans, regardless of your medical bills. Unless it offers something else the others don’t, we can discard this plan. The plan in dark green stands out as by far the cheapest plan if you have a lot of expenses, so if you are guaranteed to have $10,000 in medical bills, and to do so every year, maybe that is the plan for you.

So to pick one plan, we really need to have a sense for how likely are we in to incur different amounts of medical bills. One way to do this is intuitively. Over the last ten years I have rarely needed to go to the physician at all. There was one snowboarding accident where I broke my collar bone, but I’m not snowboarding this season. So I want a plan that has low premiums, and I’ll take the money I save on premiums and put it aside in case I do actually have some expenses. So for me, the two main criteria are (1) low overall maximum cost (I weeded these out already), and (2) low premiums.

I picked the plan in yellow. It has the lowest overall cost, while having one of the lowest overall annual maximums. If my costs end up being $3500-6000 I probably could have done better with another plan. The light green plan would have been another good choice for me.

Now if you are more mathematically inclined, you could assign a probability distribution for your anticipated medical costs, perhaps based on previous years expenses, and calculate the Expected cost under each plan. But if you don’t know what this means, don’t sweat it. Given how little data each of us has on our own expenses, you might just be better off using intuition. I tried this approach, and it didn’t change my decision.

Now, these plans DO differ in some other ways. The plan I chose gives me virtually nothing besides preventative care until I hit my deductible. Others give you cheap primary care office visits. Others low cost prescription drugs. Some, including the one I chose, allow you to contribute to a Health Savings Account (HSA), which is like an Flexible Spending Account (FSA) but better. So those factors need to be carefully considered as well. For example, if you regularly need prescription drugs, having a plan that provides them with a small copay or at least has a separate drug deductible may be of real value to you.

But this approach at least this gives you a way to visually compare the overall costs of healthcare plans for lots of possible scenarios of medical bills.